巴西橙油 ORANGE OIL CP

Due to unfavorable weather and disease, the average fruit weight is expected to be 158 grams and lower yields and fruit quality are expected.

Approximately 30% of Brazil's orange production is used for marketing and 70% for juice processing. Brazilian orange juice is expected to decline by 2% to 1.1 million tons as fewer oranges are available for fruit processing. Consumption forecasts are unchanged, while exports and stocks are down due to reduced available supply. Brazil is by far the largest producer of orange juice and is expected to account for three-quarters of global orange juice exports.

Meanwhile, Fundcurus' third forecast for the 2023/2024 citrus crop west-southwest of the São Paulo and Minas Gerais citrus belts, released in February 2024, maintains a forecast of 3,072,200 boxes at 40.8 kilograms per box, with total production unchanged from the previous forecast. This represents a 0.7 percent decrease from the initial forecast for the season. About 27.76 million boxes of the total projected production come from the Triângulo Mineiro region.

By variety, the forecast is:

-Hamlin, Westin and Ruby: 58.09 M boxes

-Other early season: 18.51 M boxes

-Pera Rio: 97.62 M boxes

-Valencia and Valencia Folha Murcha: 105.20 M boxes

-Natal: 27.8 M boxes

Considering all varieties, fresh fruit yield reduction is expected to remain at an average of 19%.

There are 5,134 orange grove properties in Brazil, most of which are large producers with high productivity.

In the long term, the trend of expansion of the orange industry outside the São Paulo and Minas Gerais regions is likely to continue. In Bahia, for example, greening disease does not exist due to the climate and distance from the main areas of the citrus belt.

Market price: $16.00/kg

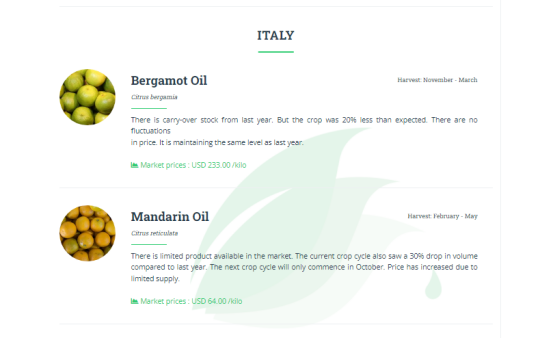

意大利香柠檬油&橘子油 BERGAMOT OIL & MANDARIN OIL

There is inventory carried over from last year. But production was 20% lower than expected. No volatility

Prices. Unchanged from last year.

Market price: $233.00/kg.

Orange oil.

Limited availability in the market. Production is also down 30% in the current crop cycle compared to last year. The next crop cycle will start in October. Prices have increased due to limited supply.

Market price: $64.00/kg

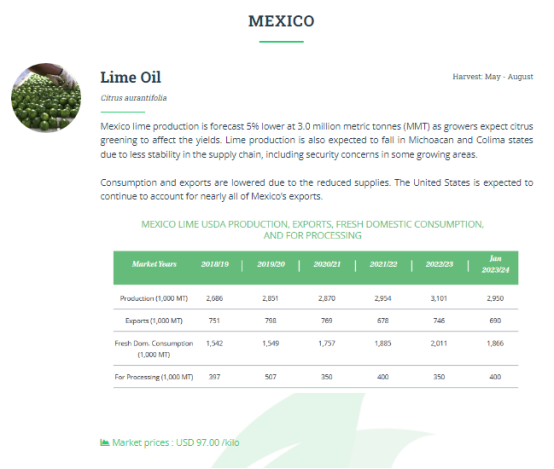

墨西哥白柠檬油 LIME OIL

Consumption and exports are down due to reduced supply. The U.S. is expected to continue to account for almost all of Mexico's exports.

Market price $97/kg

西班牙柠檬油 LEMON OIL

The lemon market is still under pressure at origin due to the increased production of fino lemons. Market demand is not able to absorb the harvest, so there are still plenty of lemons on the trees. In addition, the higher number of fruits per tree and the alarming amount of rainfall has led to the dominance of small calibers up to size 58, which is not popular in the market.

Considering the quality and high discard rate of Fino lemons, eyes are now turning to the Verna Lemon Campaign, where harvest is expected to start much earlier. Weather forecasts indicate a prolonged Verna campaign, with limited room to grow lemons in the Southern Hemisphere this summer.

After several years of low harvests, Verna lemon production is expected to increase about fivefold this year. Prices are not expected to recover with Verna given its huge production, but the campaign is expected to last at least until the end of July. Early this summer, South Africa and Argentina will face a major challenge in supplying lemons to Europe, as there will be enough Spanish lemons.

Production is not only high in Spain. Other countries competing with Spain, such as Turkey, also have large quantities for this campaign after several years of low harvests, and Italy, Greece and Egypt also have more supplies. As a result, despite demand for lemons being at normal levels, the large supply on the market continues to depress prices.

Spain is a world leader in organic lemons. Not only do Spanish lemon producers support organic farming in the EU, but Spain has become the world leader in organic farming, ahead of Italy, Argentina and the US. This in turn has made the Spanish industry the benchmark for marketing organic lemons, juices and essential oils.

In 2022, there will be 29,301 hectares of organic lemons globally, of which 11,509 hectares will be located in Spain, meaning that 40% of the organic lemons produced globally will come from Spain.

Market price: $14.00/kg

阿根廷柠檬油 LEMON OIL

Weather challenges have led to a late start to the 2023 season, and currency and exchange rate issues due to a weak local peso have compounded matters. However, there is some light at the end of the tunnel for what appears to be the worst year for Argentina's citrus industry in 2023. Last season, the first Argentine organic lemons in 20 years were exported to Europe.

The country also has a new president, Javier Miri, who promised sweeping reforms on the campaign trail. The citrus industry has repeatedly said it's too early to judge the impact of these new policies.

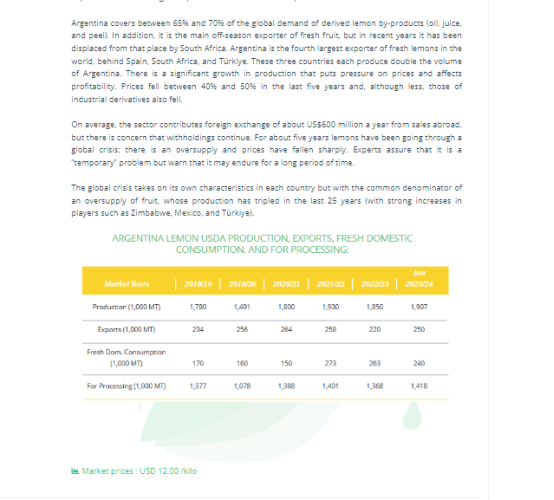

According to the USDA, Argentina's fresh lemon production is expected to increase 3% to 1.9 million metric tons due to favorable weather. As supply increases, consumption declines, while fruit for processing and export is expected to increase.

Argentina remains in first place when it comes to lemon production. in 2021 and 2022, the figure is slightly over 2 million metric tons. The cluster centered on Tucumán has economies of scale. It employs about 50,000 people directly during the harvest and about 10,000 outside the harvest. Over the past 15 years, the country's cultivated area has increased from 35,000 hectares to 52,000 hectares, despite recent adjustments due to lack of profitability. About 15,000 hectares have been cleared and another 12,000 hectares are almost completely abandoned. This situation is a direct consequence of the decline in the profitability of the activity, which in many cases reaches zero or even generates losses. This situation is exacerbated by global overproduction and the disadvantage of Argentine exports compared to other international producers

Argentina accounts for 65% to 70% of the global demand for derived lemon by-products (oil, juice and peel). In addition, it is a major off-season fresh fruit exporter, although in recent years it has been overtaken by South Africa. Argentina is the world's fourth largest exporter of fresh lemons, after Spain, South Africa and Turkey. All three countries produce twice as much as Argentina. The significant increase in production has put pressure on prices and affected profitability. Prices have fallen between 40 and 50 percent over the past five years, and prices for industrial derivatives have also declined, albeit somewhat.

On average, the industry contributes about $600 million a year in foreign exchange from overseas sales, but there are concerns that withholding continues. For about five years, lemons have been experiencing a global crisis; there is an oversupply and prices have plummeted. Experts assure that this is a “temporary” problem, but warn that it could last for a long time.

The global crisis has its own characteristics in each country, but the common denominator is the oversupply of fruit, with fruit production tripling in the last 25 years (Zimbabwe, Mexico and Turkey, among others, have seen significant increases in fruit production).

Market price: $12.00/kg